How to analyze a cash flow statement of a company?

The cash flow statement is a piece of the puzzle that helps the investor to analyze the financial health of the company.

Mainly, there are five financial statements, but as an investor, you need to pay keen attention to the balance sheet, income statement, and cash flow statement. Using these statements, it becomes an arduous task to select the best stocks in the market.

Well, you do not need to worry about it because we have a solution for you! Here, you can find the best way to analyze the cash flow statement and buy stocks, sagaciously. Let’s start understanding cash flow!

What is a Cash flow Statement?

The first step to analyze the cash flow statement is to understand what does cash flow means?

The cash flow reflects the movement of money in and out of the business in terms of income or expenditure.

Ideally, businesses try to bring in more money in the business to make positive cash flow and attract more investors.

The cash flow statement reconciles the balance sheet and income statement. It contains the cash transactions (in and out) of the company of a specific period and discloses whether the company can collect the mentioned revenues in the income statement or not.

However, it does not show all the expenses of the company. It is because not all accrual expenses are paid right away. No doubt, there are incurred liabilities, but the company mentions the transaction in the cash flow once it is paid.

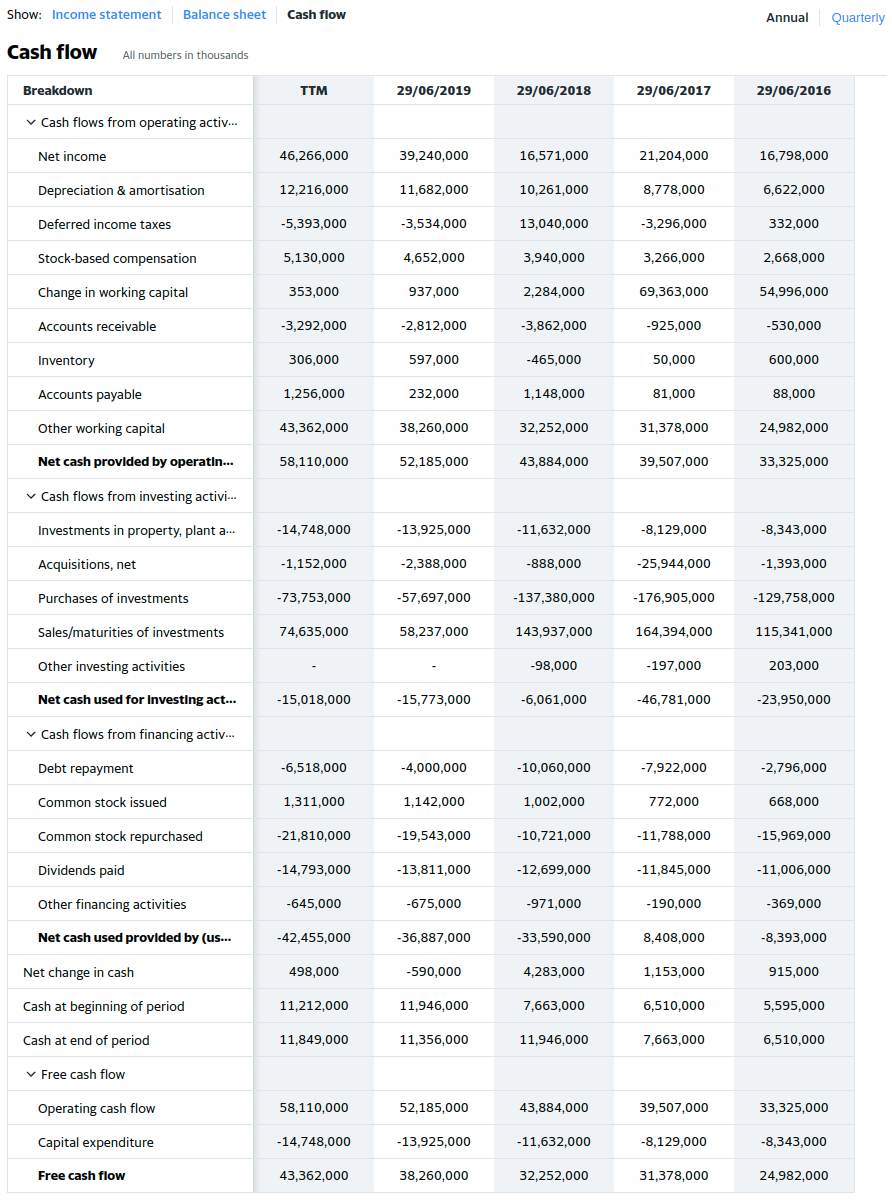

Sample cash flow statements

What you can find under the cash flow statement(cash flow statement items)?

The cash flow has three distinct sections; operations, investing, and financing. Every section is related to particular business activities and assists the investor to select the best stocks.

Cash flow from operations

Cash flow from operations includes the internal sources that generate cash for the company. If the company is unable to bring money to its core business operations, they need other external financing and investing sources.

In operations cash flow, the net income transactions are adjusted for non-cash items. It also includes the increase or decrease in working capital (a component of the balance sheet).

Cash flow from investing

Cash flow from investing highlights the cash outflow transaction including capital expenditure. For instance, expenses related to plant, equipment, and property, investment securities, and business acquisitions. On the other hand side, cash inflow comes from the sale of investment securities, and other assets.

The prime objective of cash flow from investing is to determine whether the company assets are efficient enough to support the operations of the business or not.

Cash flow from financing

Cash flow from financing has debt and equity transactions. Normally, debts are paid before paying dividends to the shareholders. Here, the investor can analyze the cash flow statement with respect to the company’s borrowing and repaying activities.

How to use the cash flow Statement for evaluating the best stocks to pick?

There are numerous stocks floating in different markets but selecting the best stocks helps the investor to earn a maximum return. Interestingly, the cash flow statement is used by many investors and portfolio managers to evaluate the best stocks and buy stocks.

The following methods are suggested to every level of the investor;

The free cash flow (FCF)

Free cash flow (FCF) portrays how efficiently the company is generating cash. You can determine it by subtracting capital expenditures from net operating cash flow. The company distributes the remaining amount among the shareholders as dividends.

The cash flow to sales ratio

The cash flow to sales ratio depicts the ability of the company to generate cash inflow from sales volume. You can find cash flow to sales ratio by dividing the operating cash flow with net sales of the company. The answer is in percentage form. While deciding to buy stocks, the investor should select the stocks of the company with a higher cash flow to the sales ratio.

Cash flow to Sales Ratio= Operating Cash Flow/ Net Sales

Importance of the Cash flow Statement

Usually, people confuse profit with cash. Here, you need to know the business might make a profit but have no cash. It is because there are two forms of accounting; accrual and cash.

According to accrual accounting, the expenses and revenues are reported when they are incurred and earned, respectively. It does not mean the company has made any cash payment to pay expenses or received the payment.

On the other hand, cash accounting reports the actual movement of money. For cash accounting, the transactions are recorded when the cash is paid in the form of expense or cash is received in the form of revenue.

The income statement is made based on accrual accounting, while the cash flow statement is made using the cash accounting concept. Therefore, the investor might find net profit on the income statement of the company but negative cash flow.

In the future, the company might run into financial problems. So, the investor should analyze the cash flow statement to evaluate the best stocks available in the market, along with the income statement.

What is lacking in the Cash flow Statement?

No doubt, analyzing the cash flow statement is crucially important for the investor, but it, somehow, lacks to reflect the actual profitability of the company. Here, the profitability includes the cash earned on non-cash items too.

Although the cash situation is a key variable for the investor, there are several other factors that an investor should consider while assessing the best stocks. E.g. assets, liabilities, account receivable and account payable, etc. These components are listed in the balance sheet and, the cash flow statement does not account for them.

Conclusion

It is recommended to analyze cash flow statement along with balance sheet and income statement to pick the best stocks in the market. To buy stocks, the investor should pay attention to the profitability of the company. If the company lacks to pay the liabilities, it means it is likely to fail.