How to Analyze a Balance Sheet of a Company

How does an investor know if a business is healthy enough to invest in? How does an investor know if a company is financially responsible and that an investment will bring a return?

There are 3 major financial statements use to analyze a company. Income Statement, Balance Sheet, Cash flow Statement.

Here we are going to discuss the Balance Sheet.

What is the balance sheet in accounting?

TA balance sheet is a report that lists the assets, liabilities, and equity of a company. The total of the liabilities and equity together must equal the total of the assets. This is to meet the requirement of the balance sheet formula

Balance sheet formula

Assets = Liabilities + Equity

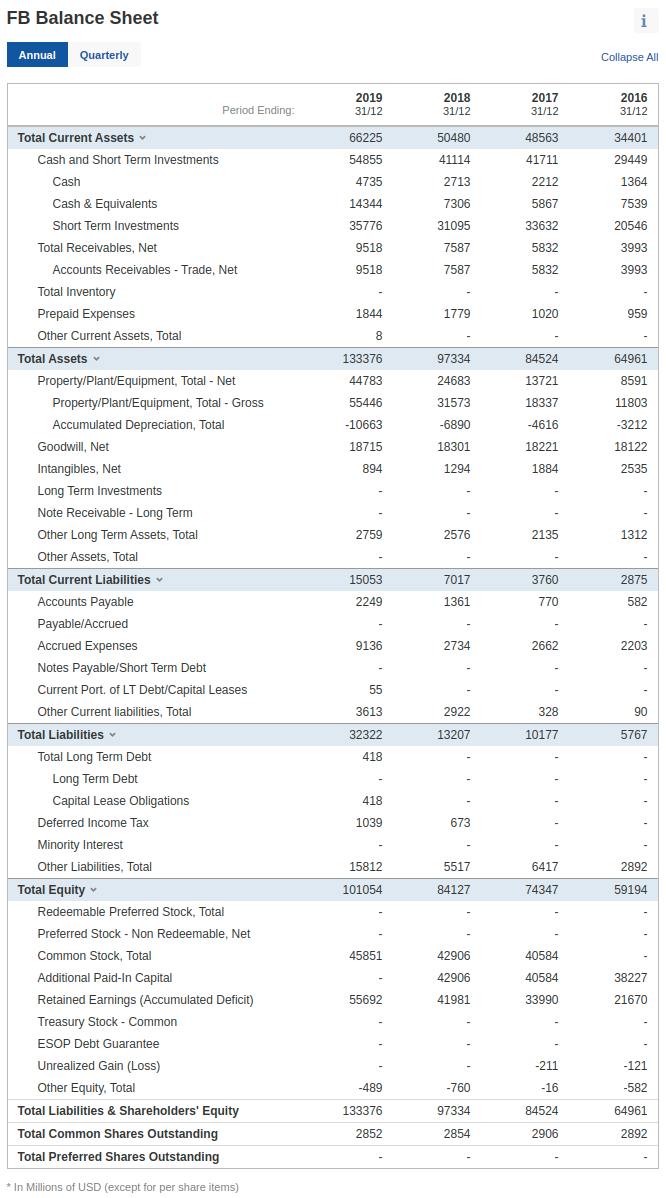

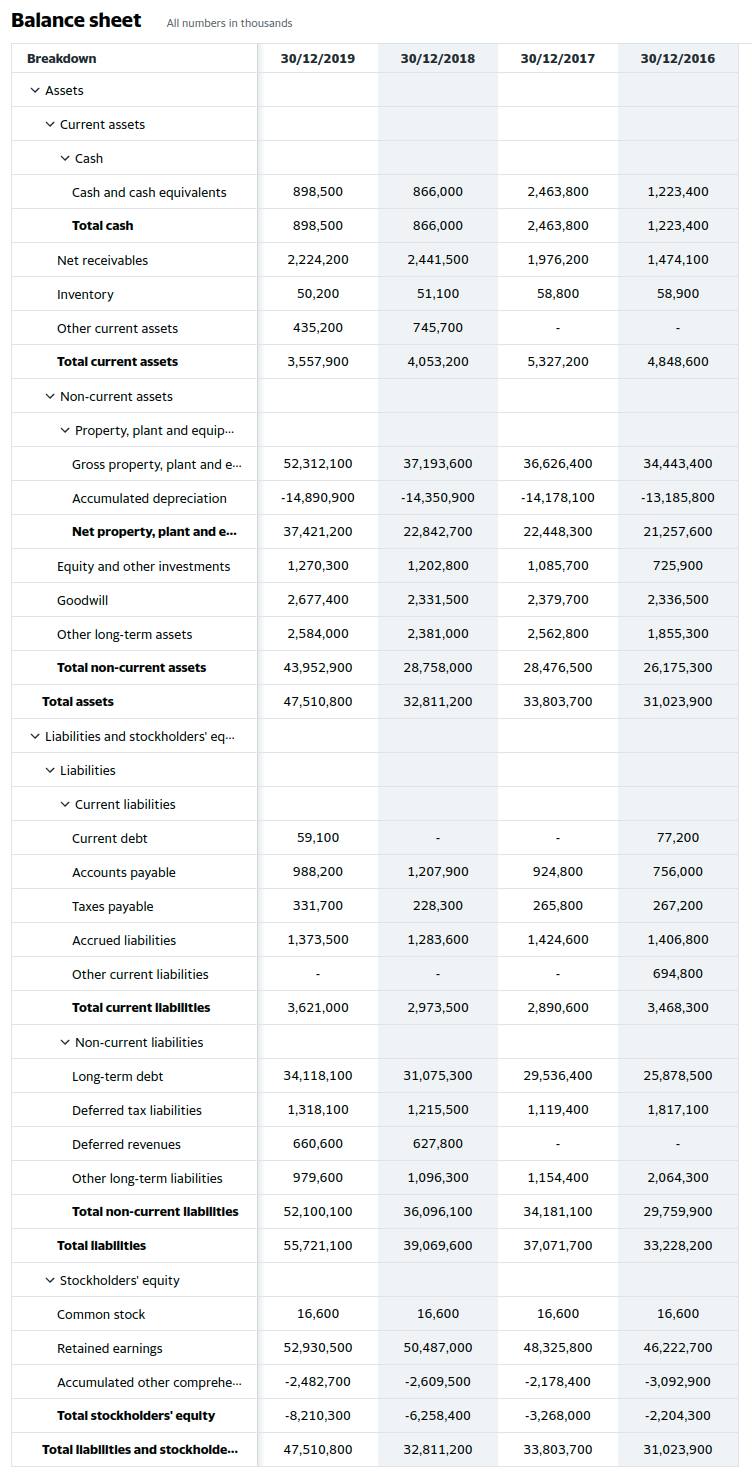

Balance sheet sample

What you can find in the balance sheet(balance sheet items)?

A balance sheet is divided into assets, liabilities, and equity.

Assets in accounting

Assets are anything that is cash or can be converted to cash. They are listed on the balance sheet according to their ease of being turned into cash. There are 2 types of assets in accounting. Current Assets and Non-current Assets.

Current Assets

The assets that will be converted to cash within a year are called current assets. A general list of current assets may include:

-

Cash

-

Accounts Receivable

-

Inventory

Non-current Assets

The assets that will be converted after a year are called non-current assets. A general list of non-current assets may include:

Non-current assets include many items that will depreciate (lose value) over time. These include things like computers, equipment, machinery, etc. This is like buying a car new and then selling it a year later. It won't be worth the same because it has lost value through use and time. Depreciation is deducted from the value of each asset each year so that their loss of value is considered.

-

Machinery

-

Land

-

Buildings

Liabilities in accounting

Liabilities are what a company owes to others. The balance sheet also divides these into current liabilities and long-term liabilities.

Current Liabilities

Any current liabilities are owed within a year.

-

Accounts Payable

Long-term liabilities

Long-term liabilities have a longer life span.

-

Long-Term Loans

-

Long-Term Debt

Equity in accounting

Liabilities are what a company owes to others. The balance sheet also divides these into current liabilities and long-term liabilities.

How is a balance sheet used?

A balance sheet can be analyzed in many ways. Many of the ways it can be used are by comparing the information found in the report to create different ratios.

Total Debt to Equity Ratio (D/E ratio)

One of the ways that investors and companies can use a balance sheet is to consider a company's ratio of debt to equity. This divides the total liabilities found on a balance sheet by the total equity. This ratio shows how a company is dealing with debt. If a company is taking greater risk, the ratio will be high showing that they are taking out debt faster to help encourage growth and expansion.

Cash Ratio

The cash ratio measures how well a company could use current cash or those things easy to convert to cash to current liabilities. This is important to consider to show how strong a company is in case the necessity arose to turn everything it can to cash and then rid itself of liabilities quickly. This ratio is figured by dividing cash and cash equivalents by current liabilities.

If the ratio is equal to 1, then there is only enough cash and equivalents to cover the immediate debt. If it is less than 1, then it doesn't have enough cash and equivalents on hand to cover the debt. If it is more than 1, then it can mean that a company has enough cash to cover debts.

Though it is a helpful indicator, the outcomes of this ratio need to be considered in relation to the other information from a balance sheet, other ratios, and other reports.

Current Ratio

A current ratio divides all current assets by all current liabilities. It considers if the current assets are adequate to meet the needs of the current liabilities if they needed to be paid off quickly. One of the best ways to evaluate a current ratio is if it is comparable to other similar companies.

How can a balance sheet be used for evaluating the best stock to pick?

Investors must learn to analyze the balance sheet to understand how well the business is doing. The debt to equity ratio above helps determine how much risk a company is willing to take. If it is taking greater risk, it may be a sign of greater willingness for the business to spend money going into debt to make more money in the end.

Using a cash ratio and current ratio also helps investors to evaluate if a company is overextending and could potentially run out of cash.

As investors consider different companies to buy stocks and invest in, balance sheets, which every company creates, can be a great way to compare the current worth and assets, liabilities, and equity of competitors.

Why the balance sheet is important?

A balance sheet is important to assess many aspects of how healthy a company is and what its current worth is. It is a tool that can be used by a company to decide if it is taking too much risk or could risk more. It can help a company to evaluate if it is in a position to cover all its necessary debts. Investors and those considering giving loans to a company will also find these uses of the balance sheet very important.

What lacks in a balance sheet?

Though a balance sheet is a wonderful report, it is only one of several important reports to help evaluate a business and how it functions. Though it lists cash and other assets on it, the balance sheet doesn't give a picture of how the cash is being used on overtime.